VYSYN VENTURES Weekly Insights #23

Markets are cyclical beasts. Trends rise and fall. Some of the more prominent bullish trends become inflated bubbles and grow extremely valuable in a short amount of time.

Several analysts have recently compared the DeFi surge to a financial bubble. But if we take a look at the market and ecosystem in which DeFi operates, we can quickly see this is not the case; far from it. To declare the “Death of DeFi” is premature and unwarranted.

In the latest VYSYN VENTURES release, we analyse the prospects of DeFi recovering based on the data at our disposal. We show how it can be misguided to discern the future of DeFi based on price performance alone. We also consider how DeFi will evolve and what blockchain will host the lion’s share of DeFi activity.

DeFi Asset Prices Enter Downward Trend

There are a few key metrics to consider when quantifying the DeFi space. Looking at the DeFi Futures chart from FTX, we can see that DeFi tokens prices have been significantly dropping. The DeFi Futures is a basket of eleven DeFi coins which includes KNC, LEND, and MKR

(Source: Tradingview.com)

This chart is in a downward trend after depreciating roughly 50% down from its peak. However, one data point rarely tells the whole story.

Considering that DeFi is still extremely early in its lifecycle, it may be premature to assume that asset prices will not recover. In the 2008-2009 financial crisis, many sectors bottomed dramatically, only to reach new higher highs in later years.

Total Value Locked Tells A Different Story

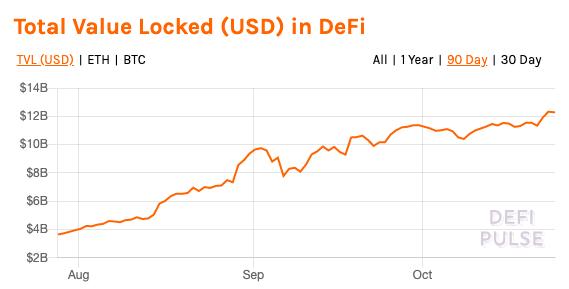

Total Value Locked (TVL) is an important data point to consider. TVL is a measure of the total value of assets held within DeFi-related smart contracts. That is, the value of all assets currently under stake or being farmed for yields.

(Source: Defipulse.com)

TVL has grown from $4 billion in August to over $12 billion in late October and is still climbing. Uniswap holds the dominant share of value currently with approximately $2.6 billion in TVL.

Even if the rewards for tokens goes down, as the previous bearish chart showed, confidence in DeFi and yield farming is only growing. Ethereum enjoys the lion’s share of liquidity and TVL.

Binance Smart Chain is a new entrant to the space but is yet to be fully tested. Other blockchains like TRON and EOS have DeFi functions but they have been largely ignored by the industry.

How DeFi Will Evolve

To date, decentralized finance has imported only the most basic legacy banking products and services. Lending, borrowing, and earning interest are relatively simple functions to create on smart contracts. But this is merely scraping the surface of what is possible, as CoinGecko’s Bobby Ong describes it.

In a series of tweets on the 19th of October, the CoinGecko CEO hypothesized that more sophisticated financial vehicles would be making their way into DeFi. In particular, the collateralization and repackaging of crypto loans.

6/ Soon we will be seeing the various crypto loans being packaged into different tranches. There may be a credit rating agency rating these different trances to give a score. How we do this in a decentralized manner is another question altogether.

— Bobby Ong (@bobbyong) October 19, 2020

Taking things a step further, Bobby believes that we could further repackage these debt obligations into CDOs or Collateralized Debt Obligations. If CDOs sound familiar, it’s because they played a vital role in the film “The Big Short” which detailed the 2008-2009 financial calamity that nearly destroyed the worldwide banking system.

Astute readers may balk at the idea of migrating potentially harmful banking practices over to DeFi. Creating tranches out of crypto-collateralized loans may seem like excessive speculation, even for crypto investors.

If this happens, there is the possibility Crypto CDOs (CCDOs) may collapse, losing millions of dollars. But this continual trial and error are all part of the process of innovation which has been embedded in DeFi since its inception.

Failures, even those that lose money, allows projects to pivot, change course, and improve on the next version. Even the CDOs that put the world on a financial precipice are still around, albeit with a few minor tweaks and changes.

The goal is not a financial product that makes an investor money but rather the advancement of the technology used to create the product. Creating, managing, and securing CDOs will likely take more complicated Automated Market Makers (AMMs) and take multiple on-chain transactions once they are ported over to a blockchain. Liquidity providers, smart contract audits, and rug pulls will also need to be solved or at the very least, mitigated.

One Blockchain to Rule them All

Several projects are currently vying for DeFi superiority. Ethereum 2.0 promises to be able to handle the workload but seems to suffer constant delays. EOS should be able to offer the required throughput but it cannot seem to garner interest from crypto enthusiasts.

The upcoming TIXL intends to implement its “Autobahn” as a way to bring any coin or token into the DeFi realm. The most likely short-term winner will probably be Binance Smart Chain (BSC). It is operated by Binance and already has several DeFi and yield farm solutions up and running.

Regardless of which blockchain brings DeFi to the masses, they are all currently complicated to the end user. Throw in a new and speculative asset class and it can quickly become overwhelming.

But one thing everyone in this space can understand is the constant march of progress. Perhaps Ethereum 2.0 will astound all with its sharding capabilities. Maybe BSC’s NAR will make people rich off of whale NFTs. Or it could be that Bitcoin’s Taproot will solve smart contract woes after all.

Either way, the interest in DeFi will only continue to grow as technology catches up to the initial spark of inspiration. Until then, expect to see more rumors and reports of the “DeFi demise.”