VYSYN Ventures Weekly Insights #3

Bullish Ethereum Developments But USDT Proliferation May Be A Double-Edged Sword

Bitcoin may blaze the cryptocurrency trail but Ethereum has been attracting eyeballs recently.

In this VYSYN VENTURES release, we analyse promising developments in the leading smart contract blockchain platform.

We further assess the rise of stablecoins and tokens on the Ethereum blockchain and whether that will be a positive or negative for the price of Ether.

For newsletters over the coming weeks, we will be presenting one long-form analysis in each release.

Feel free to reach out here if you have any feedback on the content or format.

For daily news updates, check out the VYSYN VENTURES Telegram channel.

Bitcoin may be the dominant asset among cryptocurrencies but the Ethereum network has had promising developments over the past year. Tyler and Cameron Winklevoss recently shared in an interview with The Defiant that they hold sizable positions in the second-largest cryptocurrency by market cap.

The twins revealed in 2013 that they acquired 120,000 BTC. Noting that they made a “concerted effort to buy a lot of Ether” two years ago, the accumulation by the whales suggests that they believe Ethereum price performance can outperform both fiat and Bitcoin as the network evolves.

Ethereum has certainly been making headlines recently. Both on-chain developments, Reddit adoption, and the long-awaited transition to Ethereum 2.0 have sparked much speculation relating to the prospects of the asset outperforming.

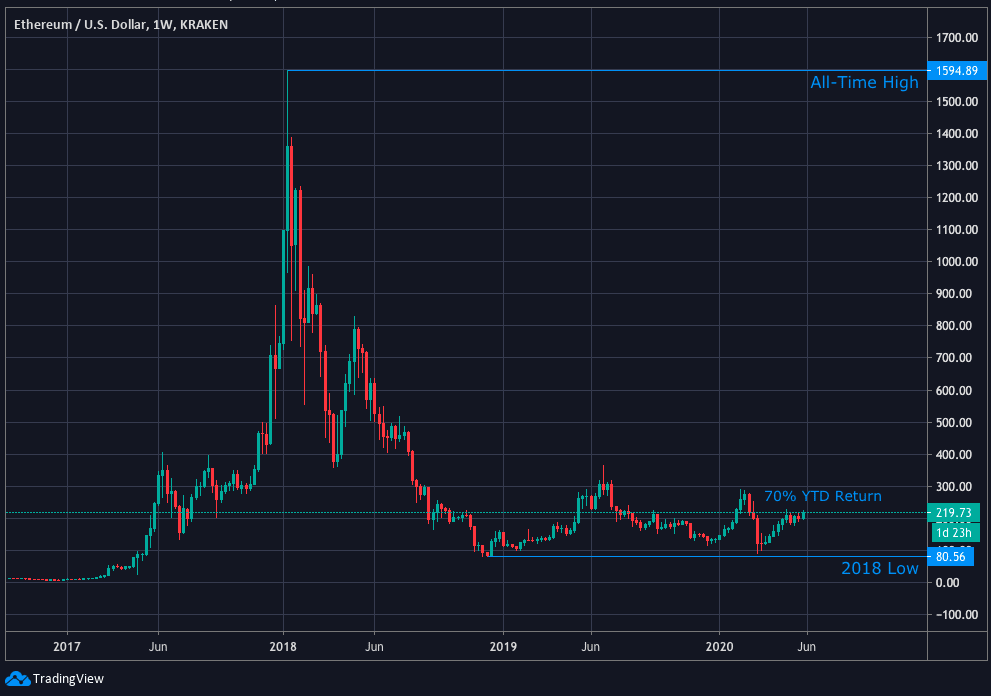

Ethereum has indeed outperformed the leading cryptocurrency Bitcoin year-to-date recording an appreciation of roughly 70% compared to a price increase of ~32% for BTC. With a market valuation of ~$24 billion, the Ethereum network remains a fraction of Bitcoin but Ethereum bulls have had several drivers spurring their optimism.

Ethereum On-Chain Activity

(Source: Glassnode & Etherscan)

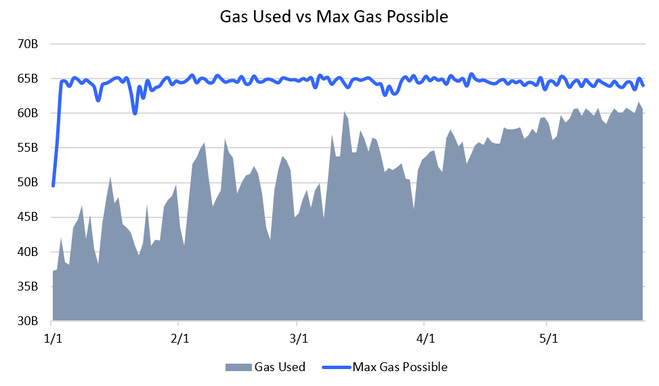

Recently, Ethereum usage has been approaching its computational capacity. Gas, a unit which is used to measure computational demands on the Ethereum network, has been approaching its maximum possible usage.

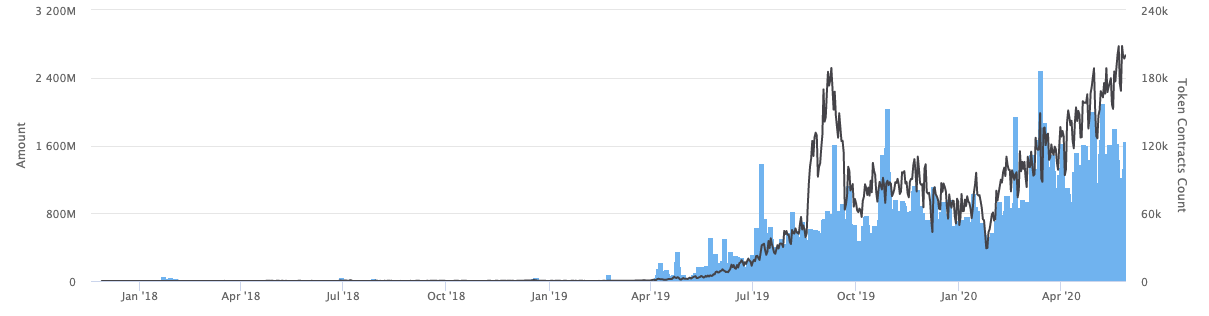

A significant driver for the increase in gas usage has been the adoption of USDT on the Ethereum network. USDT became widely used on the Ethereum network in 2019 and its usage has been increasing steadily throughout 2020. Daily USDT value transferred across the Ethereum network has regularly been more than $1.6 billion.

(Source: Etherscan.io)

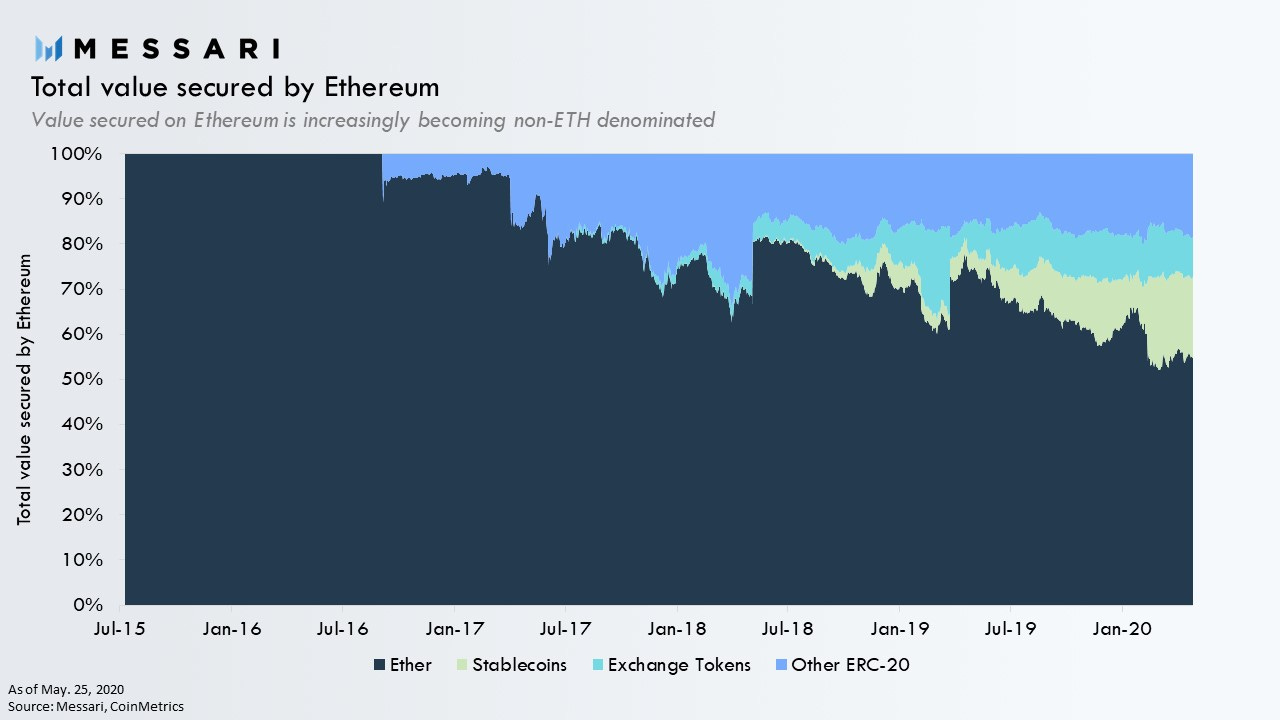

As a result of rising demand for tokens and stablecoins issued on the Ethereum, an interesting phenomenon has arisen where the value held in tokens has almost surpassed the value held in Ether. Although this may appear bullish as Ether will be required to pay for gas fees, the development may be a double-edged sword and hurt the value of Ether.

On the bullish side, transacting in these tokens drive computational demand resulting increasing gas usage and gas price which will require Ether to pay with. This large reservoir of non-ETH tokens spurs economic activity on the Ethereum blockchain far beyond simply transferring value.

On the other side, Ether has been the dominant medium of exchange on the Ethereum network.

As stablecoins and tokens capture a larger share of this role, Ether will be increasingly isolated to only serving a function paying gas fees.

In this scenario, Ether will still be valued but will take on more of a commodity-like role. To date, it has served a strong role as money but as this role subsides, we may observe Ether price paying the toll.

Given that the market for a monetary role may be far larger than a commodity role, a strong case can be made that Ether price will decline if this trend persists. Nonetheless, several metrics indicate that the Ethereum network continues to strengthen. The price of Ether may be significantly depressed compared to 2017 highs but developer activity and gas usage have continued to progress.

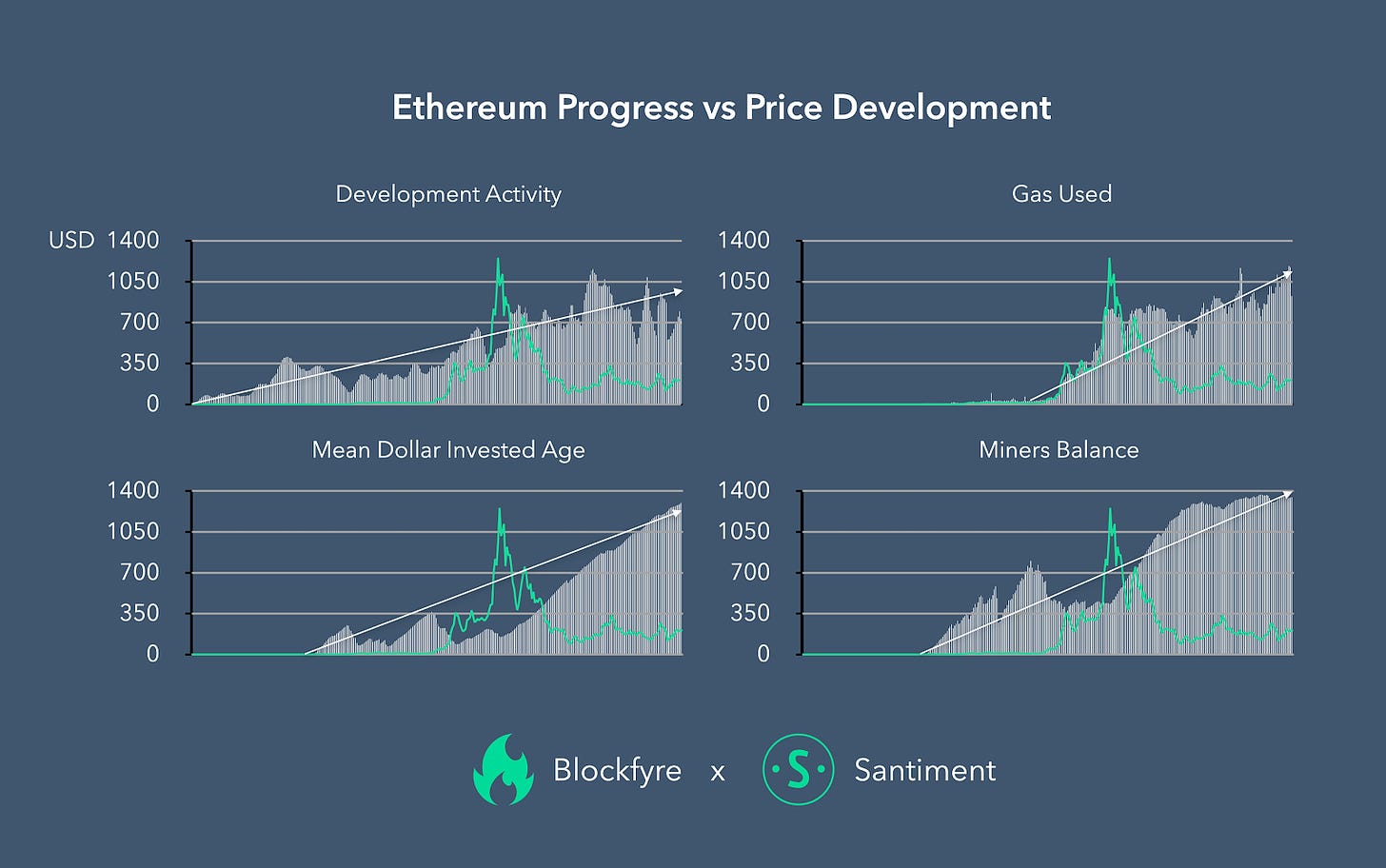

The above analysis by Blockfyre and Santiment highlights that development activity, gas usage, mean dollar invested age, and miners balance have been on an upward trajectory since network inception. Mean dollar invested age and miners balance refer to the length of time Ether has remained unmoved in user addresses and miner addresses respectively.

Enterprises Adopt Ethereum & Retail Interest Spikes

One extremely bullish development for Ethereum was the announcement that Reddit will be launching ERC20 tokens for two of their subreddit communities. The r/Cryptocurrency subreddit and the r/FortNiteBR launched the Moon token and Brick tokens respectively on the Rinkeby testnet.

These tokens will grant certain privileges to holders such as being able to use custom emojis or comment with GIFs. As we detailed in last week’s release, this development is a powerful trust signal for enterprises who may consider using the Ethereum network in the future.

This adoption by Reddit has been closely accompanied by a spike in retail investment interest. Search trends for the term “Invest in Ethereum” recently hit their highest levels since February 2018.

(Source: trends.google.com)

Ethereum 2.0 on the Horizon

Furthermore, the initial stages of the long-anticipated transition to Ethereum 2.0 is expected to finally take place in July. However, the move to a network which will be underpinned by proof-of-stake and sharding may represent a greater risk than potential reward.

We previously detailed some of the key considerations for the move to Ethereum 2.0 in our first newsletter release. As it stands, the impact the transition will have on Ether price is largely unknown. In the initial stages, both the Ethereum network and the Ethereum 2.0 network will exist in parallel with two native assets – Eth1 and Eth2.

Do you think Ethereum can outperform Bitcoin? Let us know why by tweeting @KVESTOR11.

If you found this newsletter, help spread the news by sharing among your network.

For more news and analysis, you can find us in our Telegram channel where we post daily updates.