VYSYN Ventures Analyses Crypto Market Structures – Insights #21

Since its launch in January 2009, Bitcoin has evolved from an unknown priceless asset to a globally-recognized phenomenon with a market cap of over $200 billion. It’s open-source codebase inspired countless innovators to spawn their own decentralized protocols.

The ethos of Bitcoin has enticed countless investors, business people, and developers to transition their focus to the cryptocurrency industry. As a result, a web of dispersed and varying market structures for trading these digital assets has spawned. This web consists of spot markets, derivatives instruments, OTC desks, niche markets, and a vast underling of markets that reside in messaging platforms like Telegram and WeChat.

It was not always that way. The crypto markets initially emerged in much more primitive ways. In this VYSYN analysis, we will detail a brief history of how crypto market structures have evolved. We will provide an overview of the current landscape while highlighting some of the recent developments that are causing crypto market structures to change. We will also explore some emerging projects that are anticipating changes in crypto market structures and working to position themselves as key enterprises in the new marketplace that emerges.

Rudimentary Beginnings

When the Bitcoin network launched in January 2009, only a handful of engineers and innovators were aware of its existence. Satoshi Nakamoto and Hal Finney initially maintained the network but it would not be until later that year that anyone would attempt to put a price on Bitcoin.

On October 5th, a website called New Liberty Standard established the first USD exchange rate for Bitcoin at $1 per 1,309.03 BTC. This was followed by the first known BTC/USD transaction on October 12th when 5,050 BTC were purchased for $5.02.

Shortly afterwards, the first official Bitcoin exchange – Bitcoin Market – launched in February 2010 and the first purchase using Bitcoin followed in May 2010. Early transactions were dominantly carried out over channels like BitcoinTalk and IRC but many exchanges would emerge over the coming years to facilitate fiat to Bitcoin exchanges. Arjun Balaji described the challenges faced by exchanges in the early years and how over-the-counter desks emerged to facilitate early institutional adopters.

“With bitcoin’s nascency, accessing stable banking channels was a challenge, leading to the rise of stablecoins like Tether. As adoption grew, over-the-counter (OTC) desks began servicing the handful of early institutional firms. Without sophisticated market makers, liquidity was poor. Cross-border and cross-venue spreads were often measured in single-digit percentages.”

As a new wave of participants entered the crypto market in 2017 in response to price rises, excessive demands would be placed on the rudimentary exchange infrastructure. Technical issues and malfunctions would become commonplace. This new level of demand would drive a new era of marketplace infrastructure.

Demand Drives Innovation

Several new exchanges would emerge with a focus on facilitating higher transactions volumes. This new infrastructure and deeper level of liquidity made the market more accessible to institutions who were previously limited to transacting in oftentimes illiquid OTC channels.

While crypto derivatives existed since 2014, Arjun describes how these instruments began playing a much more prominent role as “derivatives volumes grew over 25x”. Stablecoins also replaced Bitcoin as the dominant-pairing currency as speculation in altcoins and tokens became much more popular.

After the market cycle of 2017 to 2018, cryptocurrencies took on a new level of popularity among retail investors and were taken more seriously by sophisticated investors. Some analysts and firms emerged that attempted to tie cryptocurrency valuations to fundamental models but the data suggested that the market remained largely trend-driven. Several developments in 2020 suggest that this may be changing.

Sophistication Stage

The crypto market, Bitcoin particularly, has taken on a new level of recognition in 2020. 2018 and 2019 were dominated by speculative narratives as investors dealt with the bear market that ensued the 2017 price peak.

However, 2020 has seen several sophisticated investors make significant allocations to Bitcoin despite the prospect of stable or declining prices. MicroStrategy became the first-publicly firm to purchase Bitcoin as part of an asset allocation strategy. To date, the firm has purchased $425 million worth of Bitcoin.

Square Crypto followed suit and purchased $50 million worth of Bitcoin to hold in their treasury. Analyst Willy Woo anticipates that we may observe an onslaught of publicly-listed firms purchasing Bitcoin in 2021. Raoul Pal and Paul Tudor Jones are other notable investors who have made their allocations to Bitcoin publicly known in 2020.

The presence of these more sophisticated investors will change the nature of how the crypto market trades. More capital makes the market less susceptible to volatile price swings and trend-based sentiment. Public developments such as the entry of new players and underlying fundamentals will take on a new role.

Unsurprisingly, the arrival of more sophisticated investors is accompanied by a more stringent regulatory environment. While some regulations such as two recent bills in the US are bringing more clarity to crypto businesses, operators that are believed to be operating outside the bounds of the law are being chased. It is sad to see that the pioneers of the crypto derivatives landscape – BitMEX and it’s associated founders – are being charged by the Commodities Futures Trading Commission and Department of Justice.

1: Many have been joking about @CryptoHayes quick step-down in response to the CFTC & DoJ coming after them.

— KVESTOR (@KVESTOR11) October 9, 2020

There are some funny memes & gifs circulating but let's not forget that this is ultimately a sad event as someone who has done so much for Bitcoin is in the crosshairs.

Notable Projects – Wootrade and Zenfuse

The change in crypto market structures is ongoing. Several projects have emerged to help market participants effectively and profitably navigate the change. Post-2017, bid-offer spreads tightened 10x. This gave market participants access to much more liquid prices. With the arrival of sophisticated investors, crypto markets are becoming even more liquid.

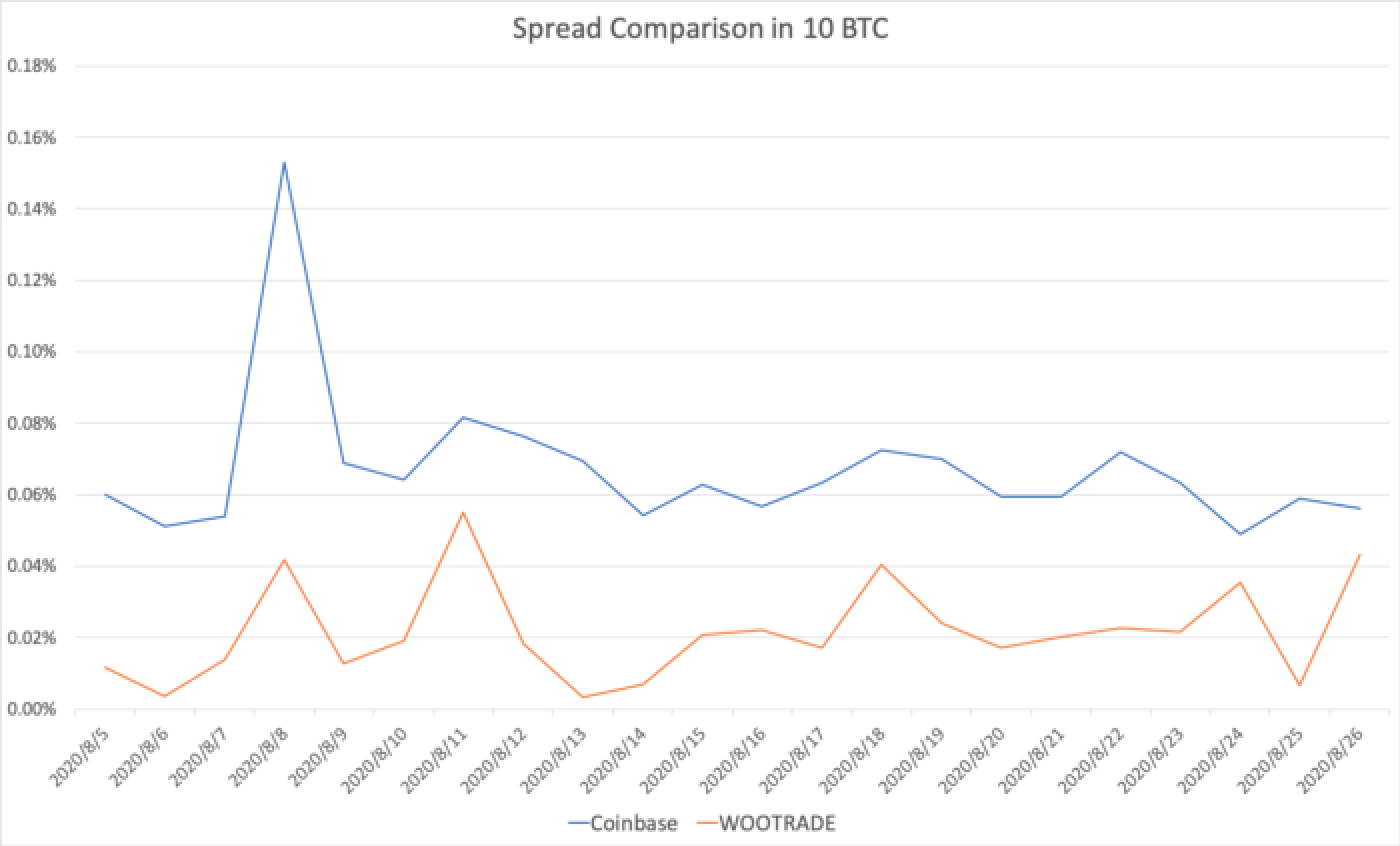

As more capital enters the market, speculators and investors will demand even tighter bid-ask spreads and more favourable fees. A new exchange is being launched to fulfil that desire. Founded by Kronos Research – a quantitative trading firm that executes a daily trading volume of over $1 billion in the cryptocurrency markets – is launching Wootrade. With market-making support from Kronos Research, Wootrade is an exchange that can offer zero fees and deep liquidity. The exchange currently has over ten exchanges and several institutional clients connected to its marketplace. With the emergence of new and bigger players in the crypto market, these entrants will source the most attractive fees and tightest spreads. Wootrade provides this with a superior spread for trading 10 BTC compared to veteran cryptocurrency exchange Coinbase.

(Source: woo.trade)

Cryptocurrency market participants will also demand more seamless access to the marketplace and advanced analytical tools to sustain their edge. As more sophisticated players gain exposure to cryptocurrencies, the difficulty of outperforming the market is raised. Zenfuse is a toolkit which has emerged to help traders compete in these new market conditions. By integrating with all the major marketplaces, traders can navigate their cryptocurrency exposure from a single interface. The Zenfuse platform also provides users with a diverse suite of features including access to advanced order types and analytical tools.

Zenfuse –

Adjective: able to think clearly; lucid.

Verb: cause (someone) to become enlightened or demystified.

Crypto Market Structure 3.0

The tides of change are approaching. Institutions are gaining exposure to the cryptocurrency marketplace while regulatory authorities make guidelines both more clear and more stringent. The primitive prehistory of vast uncertainty and little liquidity is quickly becoming a distant memory.

Cryptocurrency market structures are changing with the entrance of new players. Markets are more liquid and more efficient. Exchanges like Wootrade are emerging to provide more competitive access to this new marketplace. Likewise, traders need more sophisticated tools to maintain their edge over the new predators that have entered the market. Projects like Zenfuse are arising to fulfil such a need.