VYSYN VENTURES Weekly Insights #18

We previously explored “yield farming” and “liquidity mining” phenomena when they began attracting significant amounts of speculative activity back in June. Since then, the hype surrounding these decentralized finance (DeFi) activities has continued to grow.

DeFi speculation has surged. In recent weeks and months, we have observed volatile DeFi asset prices and the emergence of a new model for decentralized exchanges.

In the latest VYSYN release, we revisit the essence of speculating in DeFi and compare how the ecosystem matches up with the traditional finance landscape. We also analyse how DeFi has evolved in recent months and the resulting impact for Ethereum users.

Raising Rates from Zero

In the banking sector, banks sit in the middle of borrowers and lenders. They secure deposits from account holders and compensate these account holders with interest payments for their funds.

They utilize these funds to lend to entities at a higher interest rate with their income being the difference between the two interest rates. In some cases, banks will use depositors’ funds to make risky investments in search of a higher return. However, most banks do not hold the regulatory license to carry out such activities and will simply act as the middleman between borrowers and lenders.

Such borrowing and lending activities have naturally emerged with cryptocurrencies. For instance, centralized businesses such as BlockFi allow Bitcoin holders to earn interest on deposited bitcoin while BlockFi uses this bitcoin to lend to entities at a higher rate.

Over the past decade, interest rates for depositing in the traditional financial system have declined to near-zero or sub-zero in some cases. The excessive monetary expansion and negative interest rate policy have forced rates downwards and have led investors to search for higher yields with more risky instruments.

Rates are naturally higher in the crypto industry as entities are borrowing and lending with extremely volatile assets. Networks like Celsius allow users to be compensated in cryptocurrency which will result in higher rates of interest.

For instance, users can deposit stablecoins like USDT and be paid in a cryptocurrency like the imaginary McDonalds coins (MCDs). This will push up the annual percentage yield to account for the higher volatility of MCDs.

DeFi – Democratizing Finance or Degenerate Finance?

Things get far more interesting in the DeFi ecosystem. Yield farmers chase the highest yields possible and the increased riskiness of the assets which they speculate with further push up yields.

Speculators will often lend in cryptocurrency and choose to get compensated in another cryptocurrency due to the higher yields. For instance, users may lend with MCDs and choose to receive interest with the imaginary Burger King Bucks (BKBs).

DeFi becomes even more complex and fragile when the MCDs used to lend have been borrowed from another DeFi protocol. This effectively leverages the exposure and potential returns for speculators while also increasing their risk of liquidation in times of downside price movements.

DeFi speculators are constantly changing their positions to respond to the moving asset prices and potential yields. Their activities may look something like the following with the imaginary Taco Bell Bills (TKBs) added into the mix.

Sushi Swap & Uniswap v2

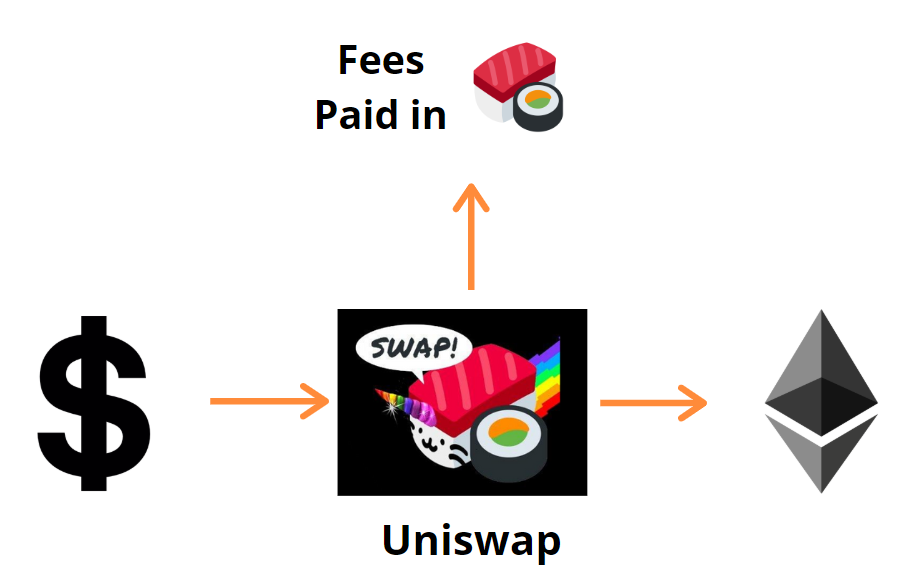

DeFi got even more interesting recently as DEXs added their own tokens to compensate users.

DEXs like Uniswap have incentivized users to provide liquidity by compensating them with a share of the trading fees.

However, an emerging DEX Sushi Swap succeeded in siphoning liquidity away from Uniswap by offering rewards in their own token SUSHI. Speculators also began purchasing SUSHI tokens which pushed yields even higher.

The speculative mania resulted in extremely volatile price movements in Sushi. The token reached heights of over $12 on FTX before sharply reversing.

(Source: Tradingview.com)

Uniswap refused to be outdone and launched their own rewards token UNI. Uniswap made 400 UNI redeemable to all Uniswap wallets. Those who held multiple wallets were able to redeem 400 UNI for each wallet.

The tokens initially traded between $3 and $4. Some sold off their tokens immediately while others held in anticipation of price rises. The market has since validated the second approach with the price rising to over $7 in recent trading.

(Source: Tradingview.com)

Centralized exchanges have also started listing DEX tokens which adds a further layer of speculative activity to the DeFi ecosystem. Both Binance and FTX have listed Sushi and Uni. These markets open trading in these assets to an enormous user base. Many such users will not have personally speculated in DeFi but can now trade these DEX tokens.

DeFi Pushes Out Other Ethereum Use Cases

DeFi speculation has caused Ethereum fees to reach extraordinarily high levels. Those who speculate in DeFi have been outbidding other use cases like minting NFT tokens and decentralized gaming.

Fees to use Ethereum have recorded their longest spell being higher than Bitcoin fees. The biggest consumers of fees have been related to Uniswap v2 trades and USDT transactions. A significant portion of the USDT transactions can be expected to be related to DeFi users urgently collateralizing DeFi positions or carrying out borrowing and lending activities.

(Source: HASHR8.com)

Ethereum has been operating close to its maximum capacity and miners have increased the gas limit per block twice since July. The increasing complexity of DeFi makes it likely that Ethereum users will be forced to continue paying a premium to transact on the network.

Ethereum use cases unrelated to DeFi speculation have been pushed aside in most cases. In the longer-term, phasing into Ethereum 2.0 or implementing developer proposal EIP1559 may make it possible to encompass all use cases of Ethereum on a single protocol. But for the moment, DeFi users are outbidding the rest and the speculation shows no signs of slowing down.