VYSYN Ventures Weekly Insights #19

Non-fungible tokens (NFTs) have recently resurfaced with heightened NFT-related activity being observed on the Ethereum blockchain. Speculation in NFT marketplaces has spiked while several DeFi projects have also been designing non-fungible tokens.

In the latest VYSYN Ventures release, we break down what NFTs are. We analyse their reemergence and consider where this niche token type may find its strongest market fit.

Fungible versus Non-Fungible

Fungibility is simply the property of sameness. The term mostly surfaces when we speak about money. In most cases, for money to function effectively, it needs to be fungible. Each unit needs to be treated the same.

In reality, most money is not fungible. Money which has been laundered is oftentimes blacklisted by governments and banks. Cash may be treated differently than electronic payments by various entities.

Bitcoin is particularly interesting when it comes to the concept of fungibility. Being able to track UTXOs on the publicly auditable Bitcoin blockchain allows anyone to analyse the history of transactions.

Coins that have been associated with certain addresses can be flagged. For instance, the blockchain makes it possible to easily monitor an address which was sent coins from an exchange hack.

Some have speculated that we will see different markets for bitcoin based on the coin’s history. To some extent, we are already observing this with miners selling freshly mined no-KYC coins at a significant premium.

However, a significant market has emerged for digital assets which are designed to be non-fungible. NFTs derive their value from being distinct from other tokens. These tokens heavily rely on the market considering their supply to be extremely scarce.

Art NFTs – Is it worth it?

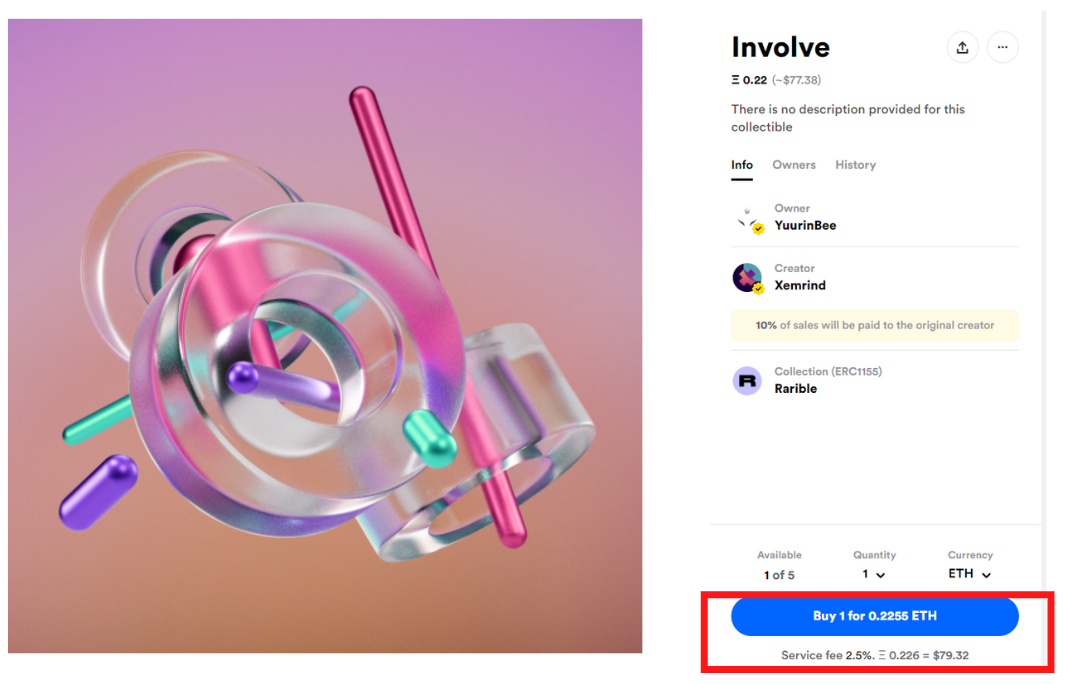

Artwork is among the most popular applications of NFTs. The go-to auction site for art NFTs is Rarible. Users can include any doodle, animated gif, or photograph in a blockchain transaction and it will then be available on the Rarible marketplace.

This enables the user to sell it for Eth. One example, Involve, was spotted selling for 0.2255 Eth, or $79.32 at recent market prices. In this case, it has been listed for 19 days and there are 5 copies available to purchase.

When we consider NFTs, several questions surface?

- Are the NFTs worth the Eth and the accompanying transaction fees?

- Disregarding the meandering topic of art valuation, does the limited number of copies have any impact on price?

- Surely possessing a copy of this art is not difficult as we were able to grab a screenshot for this article. And couldn’t the creator simply mint more copies of this token, diluting its worth?

The answers are: Unknown, Maybe, and Yes. But we are merely using Involve as an example of an NFT in its most basic form. One marketplace for NFTs in 2017 went viral. It highlighted that market participants are willing to speculate heavily with NFTs.

NFT Cryptokitties Craze Almost Cripples Ethereum

Perhaps the most well known NFTs are Cryptokitties. These digital kitten NFTs almost crippled the Ethereum network back in 2017-2018. At the peak of market activity, cryptokitty NFTs were purchased for over $100,000!

The Ethereum network became so congested with the market activity that fees rose to tens of dollars. Only the recent DeFi and Uniswap hype brought prices back to highs observed during the crypto kitties craze.

Cryptokitties is a collectables game that allows users to purchase, breed, and sell their kitten creations on the Cryptokitties website. There is a multitude of cats that can be purchased for Ethereum but the game and profit aspect is what keeps people coming back. It is the aspect of speculation that drives the hype. Similarly, how many current DeFi users actually need a loan? Very few. They’re simply speculating that their loaning and borrowing activities can increase their capital.

But while the idea of cats on the blockchain may seem a bit trite, we need to zoom out a bit and understand the impact the concept is having on the industry. Dapper Labs – the company behind our kitty cats – is attracting more attention than most realize. The band Muse is creating a line of Cryptokitties after Dapper Labs partnered with Warner Music. It is also working on additional games and a blockchain Flow.

NFTs Resurface in DeFi

DeFi projects are now scrambling to implement NFT’s. These attempts to integrate NFTs are likely an attempt to stay relevant in an ecosystem that can have boom and bust cycles of 24 hours.

One very new yield farm on Binace Smart Chain, Stakecow, plans to issue NFTs for users who farm for a long time. There has been speculation in their Telegram and Discord groups that these NFTs will be used as a way to vote for specific future plans.

Users would have to lock up their tokens and “farm” these NFTs for a specific amount of time before voting on new measures. This could ensure that only those with a long term interest in the project are allowed to vote.

Gaming as NFTs Ultimate Product-Market Fit

Gaming may be one area that NFTs will find extremely strong and lasting adoption. The blockchain gaming company Ultra ($UOS) has recently made several announcements like a promising partnership with Atari. Ultra has also partnered with Ubisoft and AMD for marketing and technology support. Where do NFT’s come in?

NFT’s can be any kind of data on the blockchain that give a non-fungible visual representation or claim. Developers could create a limited supply of specific NFTs in-game items like swords, armour, steeds, and houses.

Limiting the number of items on a verifiable blockchain will represent true scarcity instead of a database controlled by a corporation that can increase the supply of items at their discretion. Since these all exist on the blockchain, they can be sent to other users or even sold on a secondary market. The success of such models has already been demonstrated by the adoption of the WAX blockchain which provides a secondary market for NFT in-game items. There is a very sizable market for these kinds of collectables.

The Return of NFTs

In the words of Stephen King – “Sooner or later, everything old is new again.” Despite the fast-paced developments in the blockchain world, NFTs are now relevant again. The technology has been around for years but it has resurfaced with renewed interest.

Blockchain is an emerging technology and innovations like NFTs often take several market cycles to find a strong market fit. We anticipate that applying NFTs to fields like DeFi is likely to only experience short-lived hype cycles. However, gaming may be a strong product-market fit. The market is significant in scope and gamers using NFTs will likely exhibit long-lasting interaction with NFTs instead of short-lived speculative activity.