VYSYN VENTURES WEEKLY INSIGHTS #11

Crypto miners have entered unchartered territory. Bitcoin miners are currently in the midst of a rare phenomenon where prices are increasing but costs are declining. Furthermore, Ethereum miners enjoyed their longest spell where their transaction fees have been higher than those rewarded to Bitcoin miners.

Altseason was a key driver behind the lucrative conditions miners find themselves in. As discussed in last week’s newsletter, the total value in DeFi rising brought a new level of risk appetite to speculators in the crypto market. This was a key tailwind behind the appreciation across altcoins.

As altcoins recorded impressive appreciation, investor sentiment began to shift bullishly. With Bitcoin being the bellwether of the crypto market, it was only a matter of time before the bullish sentiment had its impact on the Bitcoin market. Bitcoin rose above a key area of seller liquidity at $10,550 and has since sustained prices above. At the time of writing, Bitcoin has just breached $12k for the first time since August 2019.

The Perfect Storm for Bitcoin Miners

Several factors have joined forces to catalyze the perfect storm for Bitcoin miners. The rate of Bitcoin price increases has vastly outpaced the rate at which hash rate can be deployed.

Under usual conditions, price increases mean that previously unprofitable rigs become feasible to mine with again. The hash rate deployed from these rigs results in faster block times which increases the difficulty level of mining. When difficulty rises, the cost miners incur rises. Despite Bitcoin price recently recording phenomenal increases, there have been some headwinds preventing hash rate from rising.

For instance, the largest Bitcoin ASIC manufacturer Bitmain has been suffering from severe disruption. An intense disagreement between two of the firm’s co-founders has resulted in the supply chain for Antminer rigs being effectively split in two. Antminer rigs which were ordered months ago have yet to be delivered and the company recently announced that further delays can be expected. This limits the number of new rigs which can be supplied to the market.

This means that Bitcoin miners are currently observing increased revenue while their costs remain relatively unchanged. The latest difficulty adjustment actually resulted in costs for miners lowering as the difficulty level reduced by 2.87%. Despite the rising price, the estimates for the next difficulty adjustment are also anticipating a decline. At the time of writing, the difficulty is expected to decline by ~0.6% at the next adjustment.

The severe flooding taking place in China, which holds the majority of Bitcoin hash rate during the rainy season, may be a key factor behind the declining difficulty. A high number of Chinese mining facilities have likely been destroyed as a result of the flooding.

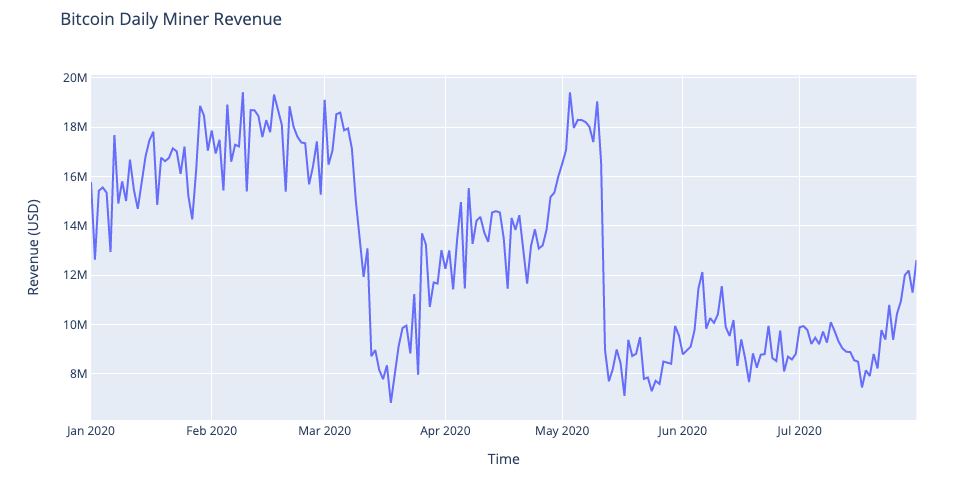

Overall, the mining industry is believed to be extremely profitable in current conditions. Prices are increasing while costs have been reducing. Recent research by BitOoda estimated that the median cost per Bitcoin mined is $5,000 highlighting that a large percentage of miners are operating at >100% margins. After the Bitcoin price increases over the past week, daily revenue earned from mining has moved above $12 million.

Data: Glassnode Studio

Ethereum Miners Flourishing with Historically High Transaction Fees

Bitcoin miners are not the only crypto miners that are currently experiencing extremely lucrative conditions. Increases in the revenue of Ethereum miners have been rising faster than increases in the price of Ether. Over the two months from the start of June to the end of July, daily income earned by Ethereum miners increased 80% while the price of Ether appreciated 50%. Daily miner revenue was $6.6 million on July 31st and further increases are expected given the ETH price increase on August 1st.

Data: Glassnode Studio

The increase in Ethereum miner revenue has been hugely bolstered by the hype surrounding DeFi. The popularity spike surrounding DeFi has increased activity on the Ethereum network and pushed up the fees which users are paying.

(Data: Glassnode Studio)

Transaction fees paid by Ethereum users have become a major portion of the block reward earned by Ethereum miners. At the time of writing, Ethereum transaction fees represent roughly 25% of the block reward. The Ethereum network is operating near its maximum capacity and miners have increased the maximum gas per block twice in recent weeks. Transaction fees earned by Ethereum miners were higher than the fees earned by Bitcoin miners for a record spell of 52 days.

(Data: Glassnode Studio)

Bitcoin miners have also been capitalizing on high transaction fees. The percentage which transaction fees represent of the total block reward is 13% at the time of writing. This percentage was typically below 2% before the May halving.

Miner Income Growth Outpaces Markets

Since June 2019, the profit margins earned by miners had been diminishing. But after the recent bullish conditions, miners are entering uncharted territory.

Bitcoin miners are in a unique scenario where prices are rising but costs are declining. Trouble in the leading ASIC supplier Bitmain is likely to keep costs relatively low for Bitcoin miners as there may be a shortage of rigs being delivered.

Ethereum miners have enjoyed their longest spell earning higher transaction fees than Bitcoin miners. With the Ethereum network currently operating near maximum capacity, Ethereum miners may be set to enjoy an extraordinarily long spell of high income.

The bull market is welcomed by crypto holders but the nature of mining means that miners will outperform. During times of stagnant or declining price action, miners struggle as their profits diminish and competition intensifies. But those that weathered such conditions can now reap the rewards of a bull market which will bring huge profit margins.